NCUA’s regulations allow a FCU to hold an investment that would otherwise be impermissible only if it is directly related to a defined benefit plan or employee benefit plan, when a credit union has an actual or potential obligation under the plan.

12 CFR § 701.19(c), Benefits for employees of FCUs, stipulates that FCUs are only authorized to hold such investments for as long as the credit union has an actual or potential obligation under the benefit plan.

Before acquiring otherwise-impermissible investments, a FCU must have the benefit plan they are intended to fund in place.1 This means the benefit plan has been formally adopted and the credit union has calculated the projected expense using reasonable and supportable methods and assumptions.

In addition to being directly related to the employee benefit that is funded, investments must be suitable for the credit union. Normal investment due diligence standards apply to all investments.

Demonstrating a Direct Relationship

To demonstrate a direct relationship, a FCU needs to:

-

Identify the existing benefit plan obligation that will be funded using otherwise-impermissible investments and confirm that the benefits are either a defined benefit plan or employee benefit plan, as defined by regulation. In order for an employee benefit plan to be eligible to be funded with otherwise-impermissible investments, a credit union must either have the plan already in place or establish it concurrently with any investment used to fund it.

- Determine the employee benefit characteristics and quantify the cost of the benefit(s). The cost should typically be quantified as the annual cost(s) associated with an employee benefit plan(s). If it doesn’t have the necessary expertise, a credit union may need to hire a consultant or vendor to determine these costs if actuarial assumptions are required for contractually obligated benefits.

- Ensure the investment(s) return characteristics meet the criteria discussed in this section of the Examiner's Guide.

For a FCU’s investment to be directly related to an existing or potential employee benefit obligation, the investment generally must have a predictable return over the time horizon associated with the benefit to offset the benefit obligation costs; the expected return must not exceed the projected cost of the employee benefit(s). FCUs may use a portfolio approach when determining if the investment has a predictable return.2

Split-dollar plans can result in an asset on the balance sheet (loan) with a predictable return even if the insurance policy backing the loan doesn’t have a predictable return. Split-dollar loan rates are determined by the credit union. Exam staff should not take exception to these loan rates unless the rates pose a safety-and-soundness risk.

The one exception is when an asset is fully matched to a corresponding liability. For example, a credit union could offer a newly-hired executive an incentive benefit designed to compensate her for a forfeited stock or stock option plan granted by a previous employer. In this example, the credit union could replicate the stock or options the employee forfeited while still maintaining a vesting schedule. The replicated benefit is equity-based, and can be matched with equity investment returns, which establishes the direct relationship of the investment. In this example, the investment is permissible because the associated asset and expense are fully matched.

Equity and Commodity-Type Investments

Investing primarily in equity and commodity type investments is generally not suitable for funding employee benefits because their expected returns are not predictable. However, there are circumstances in which a FCU can primarily use equities.

Historical return information for non-contractual-return asset classes (such as equities, stock futures, commodities, etc.) is not a reliable indicator of future (expected) returns. It is not acceptable for a credit union to assert that a contractual-return relationship exists for such asset classes just because documented historical returns are equal to the projected employee benefit liability against which they’re paired. A credit union cannot claim that expected returns on non-contractual-return investments are predictable or directly related to a corresponding benefit obligation unless the benefit obligation performs on the same basis as the investment.

Some employee benefit plans require the use of matching investments due to the nature of the corresponding benefit obligation. For example, a credit union may want to offer equity options for a senior executive’s 457(b) plan. In such circumstances, it would be prudent for a credit union to manage the exposure of having an equity-based liability by holding an identical offsetting equity asset on its balance sheet. The matched asset and liability would mitigate undue basis risk (the credit union would avoid a net long or short exposure) and meet the direct relationship requirement.

FCUs may either use investment funds with a pool of assets or use the pooled funding approach with benefits. In the case of an investment fund, a FCU must be aware of the underlying assets to determine if the investment is directly related. A FCU that uses a pooled funding approach for investments associated with a pool of benefits should quantify that the investments and benefits are directly related.3

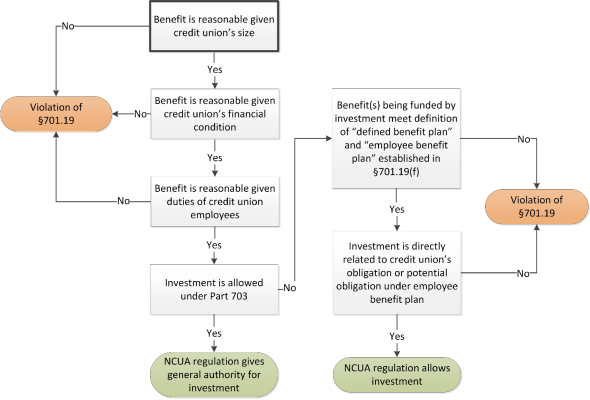

The decision tree below outlines the regulatory requirements associated with employee benefits and any investments which fund them. The information presented only applies to FCUs.

Last updated September 25, 2017